This is an updated guide for URA TIN number registration for companies in Uganda. The same procedure works for all non-individual applicants including Partnerships, Diplomatic & International Organisations, Local Authorities, Estates & Trusts, NGOs, Clubs, Society, Association, and corporations Sole.

For individual URA TIN number applicants, check out this URA Instant TIN procedure.

Whether you are a company, NGO, club, society, association, and corporation, you need to register and obtain a taxpayer identification number with Uganda’s revenue authority. The TIN is mandatory in order to transact with URA for example when filling returns, paying for value-added taxes, clearing goods and services, etc.

URA has made the process of applying for and obtaining a TIN Number in Uganda very easy. Requiring a computer, tablet, or smartphone with access to the internet, anyone is ready to apply for a TIN and have it issued within a few minutes.

In this tutorial, you will be exposed to every detail about acquiring a new NON-Individual TIN Number in Uganda right from where to go and how to get the TIN. But before we get to the point, let’s take a look at the TIN and why you need it.

What is TIN?

In Uganda, a TIN is a unique 10-digit number that URA issues to individuals and non-individuals for tax purposes. Such taxes include but are not limited to motor vehicle registration taxes, Import and Export taxes, Income tax, Value Added Taxes (VAT), Company Taxes, Operational Taxes, and many others. 1000101000 is an example of the new Uganda TIN which replaced the old P-000-10000-011 series tax IDs.

Requirements for NON-Individual TIN Number

- A Business Registration Number (BRN) – Mandatory in Uganda

Incorporated/registered entities - A valid email address

- An authorized contact person (an individual)

- Directors’ TIN numbers and IDs

Attachments for TIN Non-Individual

| Entity Type | Document Required |

| Company | Certificate of Registration Company Form 24Company Form 20 |

| Partnership | Certificate of Registration |

| Government Entity | Letter from Accounting Officer |

| Diplomatic or International Organization | Letter from Ministry of Foreign AffairsLetter from Head of Mission |

| Local Authority | Act of Parliament |

| Estate or Trust | Certificate of Registration |

| NGO, Club, Society, Association, Corporation Sole | Certificate of registration of Parliament/Legislation |

How to Register for URA Company TIN Online

- Visit “https://www.ura.go.ug/“

- Click on “eServices”

- Click on “TIN Registration”

- Wait for “New Page to Open”

- Click on “Click here to start your application”

- Check box on “Register using email”

- Enter “Email address”

- Click “Non-Individual”

- Click “Proceed”

- Enter the “Verification code” submitted to your email.

Complete the form by providing all required details and submit it at the end of the form. Your application will be reviewed and automatically approved once the information submitted is approved. You will receive an email notifying you of the new TIN number.

Note: You can use the same option as an individual TIN applicant just in case you can complete the registration using the instant TIN option.

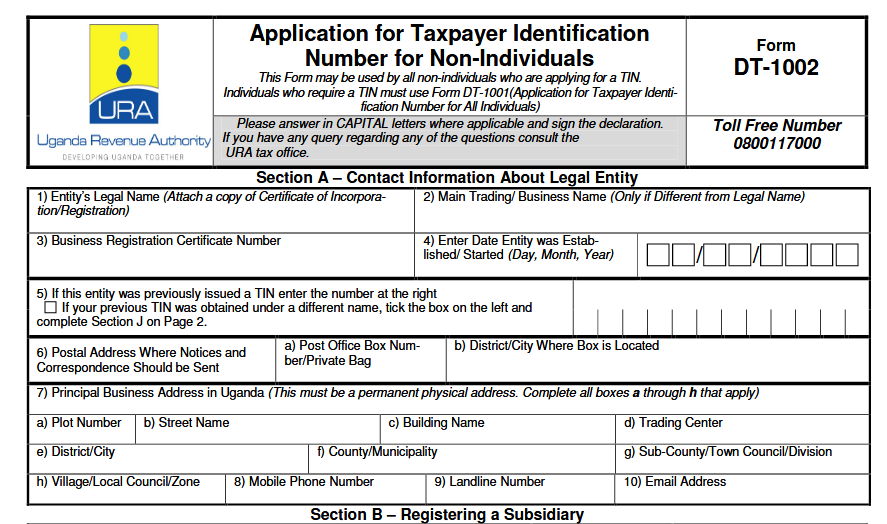

URA TIN Number Registration Using Excel Form (DT-1001 and DT-1002)

In case you are unable to obtain an instant TIN for individuals, or online TIN for Non-Individuals as shared above, you can use the old way of registering for the TIN using excel forms. And since everything begins online, having an active internet connection is mandatory in addition to having MS Office with Excel installed on your computer and Macros enabled

1. Visit the URA web portal, scroll down to “download online forms” and click eForm DT-1001 for individual or DT-1002 for non-individual and save the download on your computer e.g Desktop. This is available under forms & templates for E-Registration.

2. Using MS EXCEL, open the downloaded file DT-1001 or DT-1002and enable Macros. Fill in the entire form with the correct details from start to end. Read how to enable Macros in MS excel here.

3. Click validate so the system can automatically check if your application form is free from errors. When no errors are found, click generate the upload file and save it to the location of your choice – usually the same folder where the downloaded form was saved.

Uploading TIN application form on URA Portal

1. Visit the URA portal, click eServices, and again on individual registration for individuals, Non-individual registration for companies, and or Group Registration.

2. From the drop-down list, select the new form and browse the generated upload file. Enter the application name, and given letters, and agree to the terms. Click upload and wait for the acknowledgment number.

Well done! Once you successfully upload your TIN application on the Uganda revenue authority web portal, you will be emailed with the submitted forms which you can print either immediately after uploading the files or print using the print submitted forms feature on the portal.

The online printed forms must be submitted to the nearest URA branch office or to the exact location where your application will be processed depending on the Reference number eg, for example, Kampala South (located at Old Kampala Mosque), BW-Kampala North (located in Bwaise Mulago Kalerwe Round-about), NA-Nakawa (located towards MUBS), CR-Central offices (located at crested towers) and many other points.

Summing up

- Visit the URA portal and Download Online Forms DT-1001 or DT-1002

- Open the downloaded file and Enable Macros on Excel

- Fill the form and Validate to see if no errors and then Generate an upload file

- Upload the upload file on the web portal under eServices on Individual registration.

- Submit your forms and print the soft copy

Note: Depending on the documents you selected during form filling, for example, your ID’s and any other, you should submit the printed hard copies along with those attachments since failure might lead to your tin number application form being rejected.

And once you are verified, you will be issued a New Tin Number and you will be able to pay your taxes easily. Call or Whatsapp me 0752009001 for private express help.

Discover more from Thekonsulthub.com

Subscribe to get the latest posts sent to your email.