How profitable the money lending business in Uganda is a question many investors ask. In this post, you will discover how to start, how to grow, the interest associated, and how to benefit as a lender.

Did you know that many people in and around Kampala, the capital of Uganda make lots of extra money as profits doing small loans money lending business? Or did you know that many people in need can easily get quick loans in Kampala even with no security? How about the so-called instant loans? In this article, I share with you how exactly money lenders earn huge profits and how you too can join this booming business.

If you never knew about this, please take it from me that small loan money lending is a profitable business not only in Kampala but too in many other parts of Uganda. The more people seek money for daily use for example clearing school fees, buying business materials, or even catering for the service provided, the more money lenders earn since they are available to fill the gaps financial gaps and instantly.

Trust me, when you move around the different shopping arcades and plazas in Kampala, you will be amazed by the number of instant loans and small money lending providers. Yes, the business community uses these money lenders to fund their businesses and or cater for missing gaps just in case and the amount to return is determined by the lender’s interest rate which is agreed on between the borrower and lender.

Recently, I took a short visit to a number of small loans instant money lending service providers around Kisenyi, a Kampala city suburb and I was very amazed. The few minutes I spent in either of the offices made me see very many people coming for quick loans (they referred to them as 10 minutes aka express).

On Roza Market building, for example, I found over 7 quick and instant loan providers with each having their own targeted people and offering them loans at their own interest rate which ranged between 10-15% with different repayment plans. Oh yes, money lenders earn big because of the way the borrowers use and return the monies.

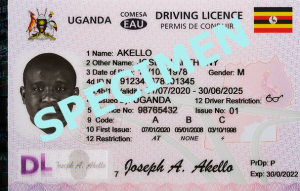

In my survey, I discovered that while these lenders operate as registered businesses, their formula of recovering poor payments from borrowers who take them reluctantly when the payment time is different and special. Many go to court and file cases as small claims other than companies and believe me, they do recover their money.

People who deal in 10-minute deals/business take these quick small loans as very advantageous and useful since they are able to complete their deals and businesses instantly using these quick loans in Kampala. Oh yes, instant walk-in, instant acceptance, and instant money thus saving one from the lots of paperwork as the case for the banks.

Well, need to know how you can get started or join this booming quick/small loans/money lending business in Kampala or in any other part of Uganda? I have created this guide specifically for how to start a quick loan money lending business which is sure when followed can turn that dream into reality.

Discover more from Thekonsulthub.com

Subscribe to get the latest posts sent to your email.