Here is how to file vat returns and pay as you earn tax in Uganda. Also, understand who pays VAT, where to get started, and how it all works.

What is VAT?

VAT stands for value-added tax. A Valued added tax is that type of tax that is added to the consumption amount.

What is PAYE?

PAYE stands for Pay as you earn. Pay as you earn is a withholding type of tax that is levied on employee payments/earnings.

What is Income Tax?

Income tax is that kind of tax that is levied by the government to the taxpayer on his taxable income.

In Uganda just like in the US with the IRS, its the work of the Uganda Revenue Authority (URA) to ensure that all the above are paid by the taxpayers to the government and as a must, all employees are required to pay just like it is for all incomes earners who earn incomes in a taxable range.

In the past, most of the things in Uganda were done in the manual way which involved the tax-payer having to go to the URA branch for making a payment unlike nowadays when everything was almost made possible to be completed on the internet where by visit the URA web portal means quick access to all kind of forms which once filled can ease one’s process of making a payment and then simply making a filing afterward.

And as we know well that while the minority people maybe know such kind of information with regard on how to do things, there are many people and in fact the majority who have no knowledge of how it works and which is why this article, you will get to know how you can personally go on the entire process of processing your payment forms for VAT, PAYE and Income Taxes online in Uganda and below we get started.

How to Pay VAT in Uganda

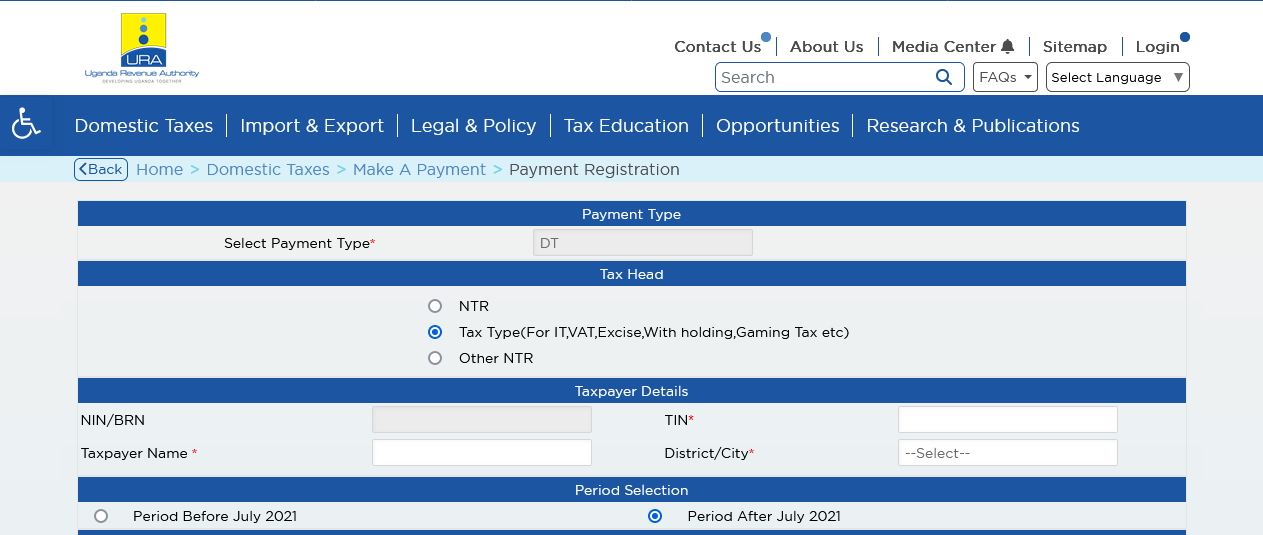

- Visit “ura.go.ug“

- Click “Payment Registration”

- Check box “Tax Type(For IT,VAT,Excise,Withholding,Gaming Tax etc)”

- Enter “TIN Number”

- Select “Value Added Tax” under Tax Head

- Enter “Amount” to pay

- Enter “Given Text”

- Choose “Payment Method”

- Click “Accept And Register”

- Print the payment registration pdf form containing the URA PRN on the next page, take it to the selected URA collection bank of choice and make the payment.

Discover more from Thekonsulthub.com

Subscribe to get the latest posts sent to your email.