In this post, I am sharing with you a list of those banks where you can be able to pay all of your Uganda Revenue Authority – URA taxes and any other fees. One reason why you need to know this list is simple; to be able to make a choice during the payment registration (PRN) generation.

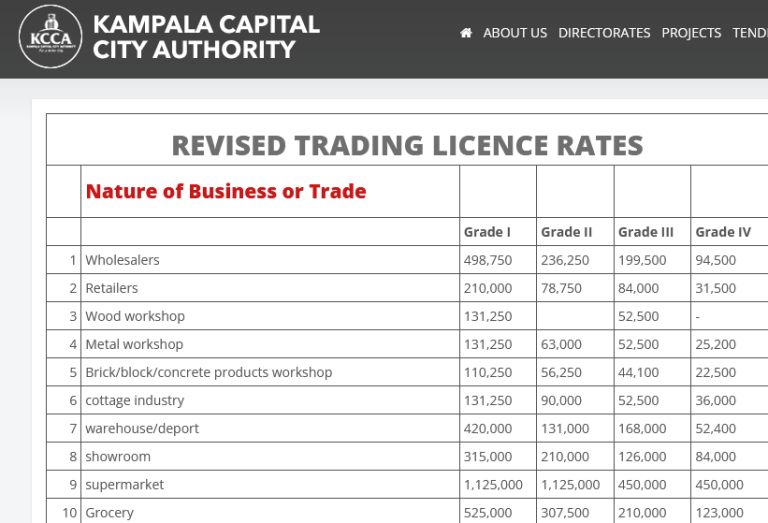

And regardless of whether you want to pay withholding tax (WT), value added tax (VAT), Property tax (PT), Income tax, Stamp duty, Custom duty, Local Excise, Motor vehicle, Immigration, Government tenders, Police fines, Driving License fees, Gaming and pool betting tax, and any other, below is the list you need to know.

1. Bank of Africa

2. Bank Of Baroda

3. Barclays Bank

4. Cairo International Bank

5. Centenary Bank

6. Citibank

7. Crane Bank

8. Dfcu Bank

9. Diamond Trust Bank

10. Eco Bank

11. Equity Bank Uganda Limited

12. Finance Trust Bank Limited

13. Guaranty Trust Bank Uganda Limited

14. Housing Finance Bank

15. Imperial Bank (Uganda) Limited

16. KCB Bank Uganda

17. NC Bank Uganda Limited

18. Orient Bank

19. Post Bank Uganda Limited

20. Stanbic

21. Standard Chartered

22. Tropical Bank Ltd

23. United Bank For Africa

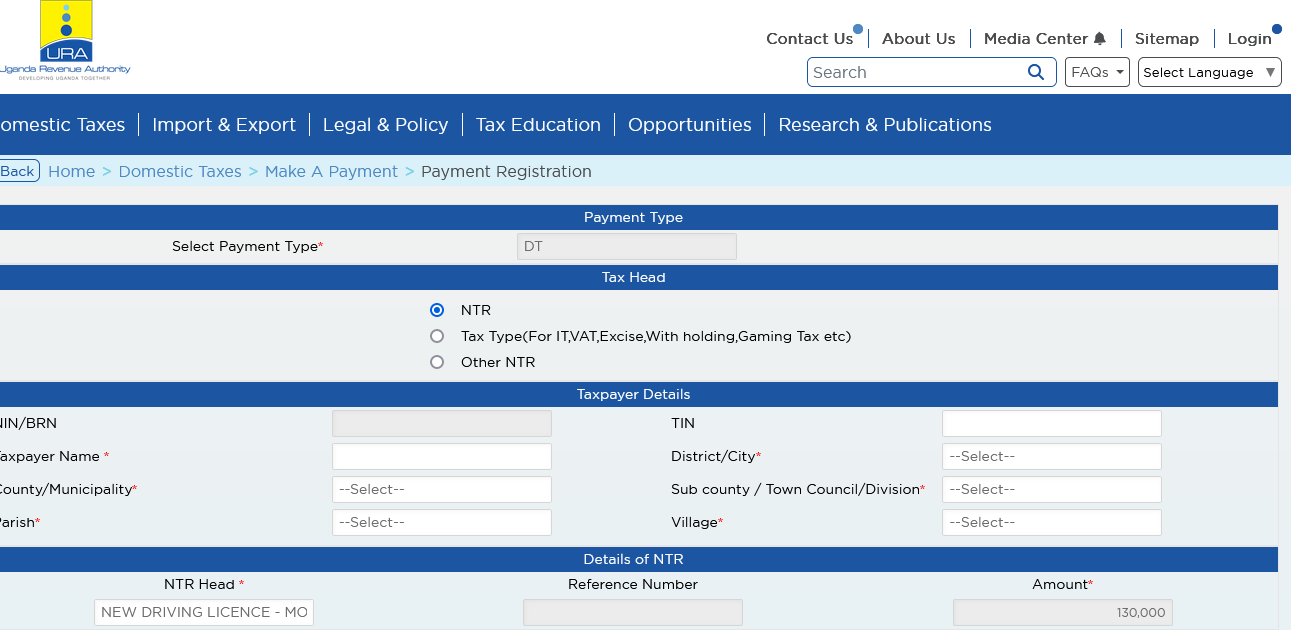

In order to create or generate a URA PRN in your bank of choice, all you need is to follow the following below.

1. Log on to the URA web portal and click the eServices link.

2. Select payment registration under Payments and wait for form to load.

3. Scroll down under URA’s Banker Name and chose your bank from the list.

Discover more from Thekonsulthub.com

Subscribe to get the latest posts sent to your email.